- By A. CH.

- February 16, 2023

- Get Started

5 Lessons From Self-made Millionaires on How to Become One

Daydreaming of becoming a millionaire? Curious how to start building your wealth? Looking for advice from self-made millionaires?

Today, we will explore five lessons taught by next door millionaires on how they made their 1st million and built their wealth.

When growing up, I thought flashy cars, branded watches/bags and big houses were the definition of wealth. But, after reading the book “The Millionaire Next Door” by Thomas Stanley and William Danko, my perspective changed.

The story goes back years… Stanley and Danko (Book: The Millionaire Next Door) wanted to meet real millionaires and conduct research on the topic. There weren’t many papers on the topic, so finding those millionaires was a bit challenging. As you see, many millionaires don’t have the time to sit around and talk about life. Time is money!

Eventually, they managed to gather 150 millionaires. The next goal was to identify common characteristics and habits of the wealthiest. After all, their quest was to find the golden recipe for acquiring wealth and becoming a millionaire.

Well, they (also) surprisingly realized that being rich is not a (direct) synonym for wealth… and that anyone could be a millionaire or not! So, the only criterion to participate in the interview was to have a net worth of at least 1 million USD.

To clarify, “Net Worth of 1 Million USD” means …

According to Cambridge Dictionary, net worth is “the value of the assets (= property and money) that a person has after any debts are taken away”.

Essentially, a net worth of 1 million USD means if you could convert all your belongings (stocks, cars, houses, etc.) to cash and use this money to pay off all your loans, you should still have 1 million USD left in your bank account.

NET WORTH = ASSET – LIABILITIES

Cash, Bank Accounts, Retirement Funds, Investment Accounts, Real Estate, etc.

Money owed to family & friends, Credit Card Debt, Loans, Mortgages, etc.

The millionaires that the authors gathered varied, from small business owners and accountants to teachers and single moms. The authors’ first impressions were: Why do they look “common”? Where are the superstars, doctors, politicians, etc.? What are we missing here? They were shocked!

Well, they asked for a net worth of at least $1 Million, didn’t ask who has the biggest paycheck, but who actually managed to create wealth. Interesting, right?

So, let’s take a look at the five lessons that the self-made millionaires taught Stanley and Danko (the book authors) on how to become a self-made millionaire:

Lesson #1: Save up!

Undoubtedly, saving is the first step and most obvious rule of growing wealth. However, it’s highly ignored!

This is how the story goes.

Salary received. First thing?

Online subscriptions paid via direct debit (streaming, delivery, music, etc.), buy the “bucket list” luxury item of the month (clothes, watch, hi-tech, earrings, you named it), arrange an extravagant night out with friends, buy all those “unnecessary” things sitting in your online shopping list, go grocery shopping (alcohol is the #1 item in the list), pay obligations (loan, rent, insurance, etc.), spend some money on health and growth (physical and mental), and save any bread crumbs left, if any.

Shouldn’t we follow the exact reverse order?

So, whose paycheck is this again?? OURS!

Then, why don’t we pay ourselves first, before anyone else?

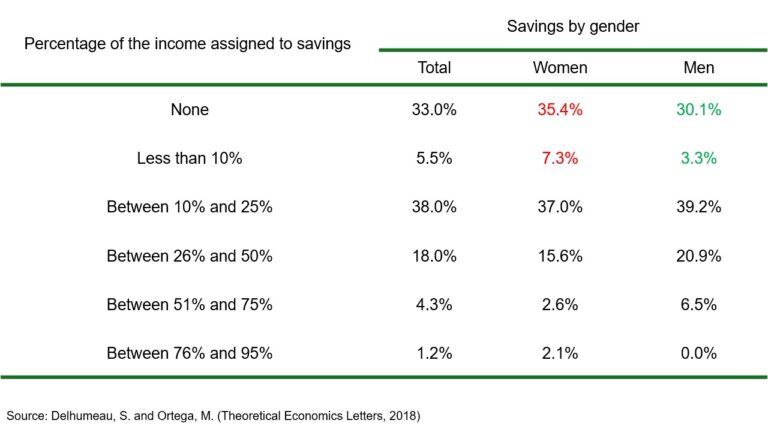

According to Delhumeau and Ortega, 3 out of 10 people save nothing at the end of the month! While Vanguard, one of the most successful investment advisories in the world, suggests we save at least 12-15% of our pay.

Generally, paying ourselves first means we set as a priority our well-being (stress-free life, health, happiness). If you add both saving and investing as the first thing on your to-do list, you will save yourself from any future unpredicted financial headaches.

Researcher, Talya Miron-Shatz, from Princeton University, says that even if you are making a hundred grand a year, if you are constantly worried that you are going to get fired (=one source of income), you are not going to be happy.

Importantly, it’s not about how much someone is making, it’s about creating financial security, exactly what the book of Stanley and Danko says (Book: The Millionaire Next Door). In short, everything comes down to net worth and financial management, not what’s the number on the paycheck.

Money Tip

Build an emergency fund. Particularly, save up to 6-8 month worth of living expenses in a separate account from your currency account. Avoid spending this money, but only when it’s really needed.

After, crossing out saving from your checklist, you can splurge on luxuries or take your friends out for drinks. Fair enough?

Interested in saving more money? Read the Moneypoly article on how to grow your savings.

Lesson #2: WHEN, WHERE and HOW to spend money

What’s a common thing between a brand new watch and a broken fridge? On both occasions, we want or need to spend money, willingly or unwillingly.

The second lesson from the next-door millionaires is about knowing when, where and how to spend money. Before buying, you always need to understand your needs, compare, negotiate and choose wisely, otherwise, you either waste money or leave your money on the table for others.

Story Time…

Recently, we went on holiday and we decided to travel to a different city. It was Sunday at 2 pm and we decided to splurge on a rented car. Before entering the first shop, we decided on our “internal” budget. A 5-hour bus ticket with return was $30 and a one-way taxi ride was $60. Therefore, we settled at $105 (max) for a 2-day car rental.

The first shop asked for $100/day. Way over our budget. We thanked them and immediately left.

Next, shop #2 offered us a “bargain”, $100 for a 2-day rental and a more comfortable car. But, a bigger car equals more gas! They said because it’s Sunday afternoon, they are (almost) sold out, but they can “help” us by giving us a bigger car for a cheaper price.

All of a sudden I go, BINGO!!

Market insight unlocked! If they haven’t rented out their car by Sunday noon, it’s highly possible that they won’t rent it. Basically, they lose revenue if they have any cars sitting in the garage. We let them know that we will consider it and left with a smile. Onto the next one!

At the third shop, we got a deal for $42/day for a smaller car with economy mode and extended the return time by 2 hours. We took it!

Briefly, we saved $21 compared to our budget, got an easy-to-park car with economy mode and extended return time for free.

Obviously, talking with other shops, help us collect information, allow us to identify a good deal, prepare us to negotiate at the right time, and eventually help us to strike a fantastic deal in less than an hour.

Money Tip

When you’re the buyer, try to collect as much info as possible, without relying only on information provided to you by others, do market research and negotiate, if it’s possible.

Of course, it also depends on the purchasing price of the item, how much time you want to spend, and to what extend the item/service improves your life. We could walk to the destination, instead of renting a car, and save all the money, but that would take 10 hours from our schedule and the hot weather would knock us out before arriving. No, thank you!

Something Interesting: The Millionaire’s Car

The authors of the book Millionaire Next Door discovered that the most common cars among millionaires are second-hand Jeep Cherokee and Ford F-150 Pickup. These cars offer the highest value per mileage. The key word here is second-hand!

Lesson #3: Rip off the “financial” bandage

According to Financial Post and Blair Trippe, “They [children] are often living off their parents’ largesse. Their identity [is] dependency. To be an inheritor is very challenging for a lot of people.”

Another lesson that the book teaches us is how detrimental financial aid could be. Occasionally, wealthy parents tend to help their children with big monetary gifts; but, this might harm them in the long run, as they might rely on the easy constant flow of money.

Money Tip

Received monetary gifts? Put it immediately in your investment or emergency fund account. DO NOT buy unnecessary things that you couldn’t afford anyway.

Lesson #4: Invest

The fourth lesson and one that shouldn’t be ignored is investing. Investments vary from real estate, bonds, art, stocks, business ventures and anything else that can increase in value over time.

Certainly, investing, when it’s done wisely, is a good way to help us grow our income or at least protect it from inflation and other economic phenomena.

The other day, I was talking with some friends and they believe investments require big amounts of money to start with. But, who was one million from one day to the other to invest? Money will never be enough to start anything (business, family, investing, etc.).

Myth Busted

Investing DOES NOT require big amounts of money. There are investment opportunities for just $50.

Money Tip

An additional tip to decrease your financial headaches and worries is to create a different source of income that is not connected to your job. Investing can help you achieve this, but always needs attention, researching, learning and being fully aware of your decisions.

Investing is simple, but not easy. – Warren Buffet

Lesson #5: Takes time!

The millionaires that Stanley and Danko interviewed, spend on average 40 hours a week on money management. That’s a lot!

Generally, there are many things going into the financial management of your household: investment alternatives, business ventures, tax, budgets, research and many more.

However, I believe 40 hours (= full-time job) is a bit excessive and not feasible nowadays, but starting with 2-4 hours every weekend is possible. Undoubtedly, the earlier we start learning, saving and investing, the faster we will receive the fruits of our efforts.

The Conclusion

As a matter of fact, achieving financial independence and becoming a millionaire requires time, knowledge, effort, discipline and patience, like any other goal in life.

To wrap up, “The Millionaire Next Door” book by Thomas Stanley and William Danko is an insightful masterpiece and provides timeless life lessons to the ones who are ambitious enough to become millionaires. The most important lessons taught by the authors are: save, know where/when/how to spend money, don’t rely on others for financial support, invest and allow time for your fruits to grow.

Want to get serious about becoming a millionaire? Get started now, here’s a list of the six easy-to-read books to improve your financial literacy.

Article by A.CH.

References:

Stanley, T.J. (1996). The Millionaire Next Door. New York Pocket.

Rivera, S.D. and Ortega-Pérez-Tejada, M. (2018). Knowledge for Overcoming Adversity: Gender Analysis of Economic Culture in a Region in North-Western Mexico. Theoretical Economics Letters, 08(07), pp.1313–1331. doi:10.4236/tel.2018.87085.

How much to save for retirement | Vanguard. (n.d.). Investor.vanguard.com. Retrieved September 27, 2022, from https://investor.vanguard.com/investor-resources-education/retirement/savings-how-much-to-save-for-retirement