5 Ways to Grow your Savings

Learning how to save money or grow your savings account is a skill that can be learned.

But, not having enough money in a savings account or cash on the side is a plan for disaster.

Attention: The goal is not to grow a fat Savings Account but to have a diversified portfolio, which partly includes fast cash convertibles for your short-to-medium goals or needs.

Let’s go through the five most useful tips that will make you a savings guru and help you grow your savings account:

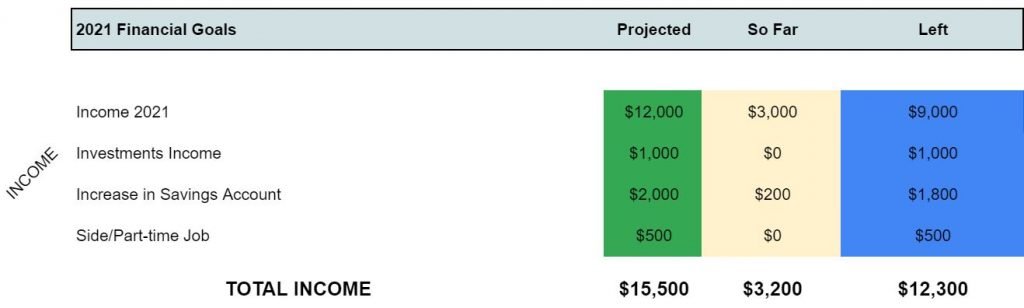

1. Set a monthly savings goal.

Budgeting and setting up financial goals will be your best friends in your financial journey.

In the beginning, it will be hard, as every change. I know. Nonetheless, see this as a challenge for your financial independence and your road to financial freedom.

Not having any source of income?

Get a job (part-time, full-time, contract-based, freelancing, ask your neighbors if they need some help to mow the lawn). Something (legal of course) that will bring money into the yard.

Have you got (short-to-medium term) debts?

It’s okay to not have major savings, but still try to save at least 5%-10% of your gross income and try to pay off that credit card or student loan ASAP. Stop that vampire from drinking your blood!

For instance, if you want to save $100 in the month of June, write down that number somewhere to remind yourself daily: a sticky note on your laptop, background on your phone, on your fridge. Translating your goal into a number will make it easier to achieve.

Net Income: Any source of income minus Tax/Social Insurance minus Unavoidable Expenses such as mortgage payments, rent, gas etc.

Well, unavoidable expenses don’t mean Stardollars frappuccinos or buying the same T-shirt in three different colors.

2. Record your expenses.

More specifically, download an Expenses Tracking Smartphone App (many free versions out there) and track every single expense. From a bar of chocolate to your utilities and from a coffee run to a spoiled night out with your friends.

Following Tip #1, set up weekly goals of how much money you can spend in order to meet your savings goal. In other words, keep a journal of your expenses to help you balance your needs and income.

Difficulty in tracking your expenses? Download this free tracking expenses Template.

Setting up your financial goals will keep you on the top of your financial game.

3. Time to “declutter” your expenses.

When was the last time you said: “I didn’t need that coffee today”, or “I spent so much money yesterday night. I regret it!”, or even “That wine wasn’t worth the bucks”?

After you track your expense for 2-3 weeks, it’s time to start understanding certain buying patterns or your buying personality, if you like. This will result in helping you cut off certain expenses and increase others. Another important point here is to treat yourself once in a while for achieving a goal or your once-a-week treat. It’s fine to spoil ourselves once in a while!

4. That Lunch Box.

From personal experience, one of the biggest money savers is the lunch box. As simple as it sounds, sometimes we are just too busy or bored to prepare our own lunch box (perhaps even dinner) or snacks for work. Bring your own lunch box and snacks at work, it’s a lifesaver!

5. Subscriptions.

Subscription is a big chapter of Millenials. Do you remember those comics subscriptions when we were young? Yep, it’s the same idea.

In fact, the subscription model is freaking profitable for companies.

The American Press Institute reports: “87 percent of Millennials personally pay for some type of subscription service.” 87% is insane, isn’t it?

Again, evaluate. Do you need this subscription? If no, get rid of it. Alternatively, find creative ways around it. Share with family/friends, find more cost-effective alternatives, suggest to your company the corporate package or get them on a discount.

Your income is your time spent working away from your family and friends. In other words, it’s your time standing or sitting on a chair for consecutive hours challenging your body and your brain. Similarly, spending your income without thinking is like you are throwing your time into the trash.

I hope the above blog post motivated you and gave you enough tips on how to grow your savings account.

Don’t work harder, think wiser!

Talk to you soon.

ACH